Economy / 08 August 2024

An inflationary rift has developed

The Squiz

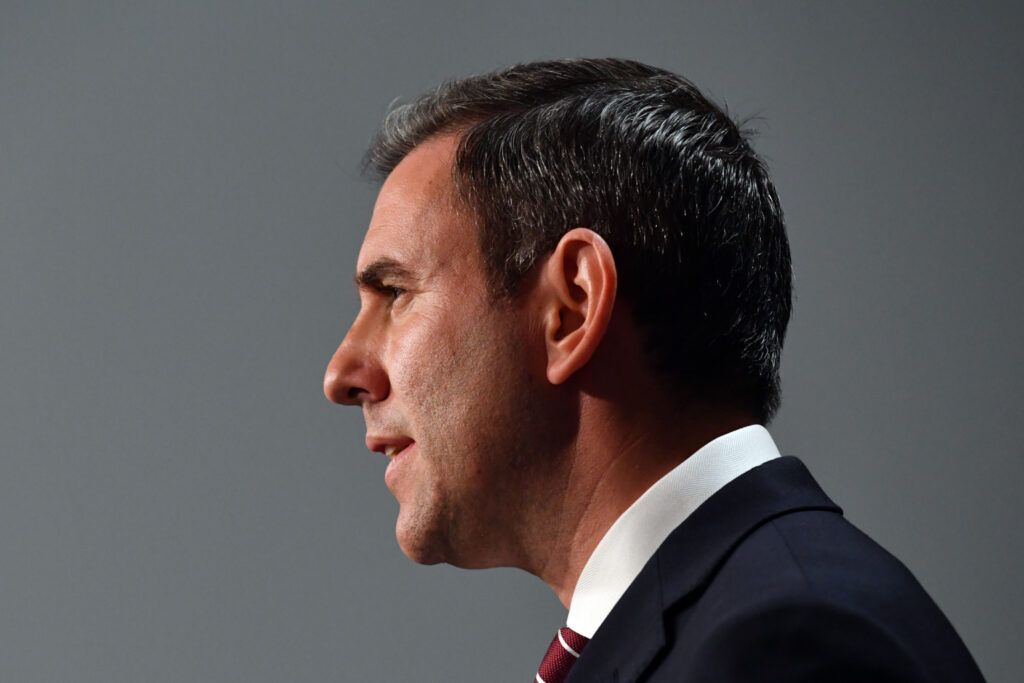

No sooner had the Reserve Bank made the call to leave interest rates on hold at 4.35% on Tuesday than bank officials had to front up to a Senate inquiry hearing yesterday – and what officials have had to say has put them at odds with Treasurer Jim Chalmers. It’s down to a difference of opinion over the support Australian governments have given to us punters to deal with cost of living pressures, the effects those subsidies have on inflation, and our unbudgingly high interest rates.

Shouldn’t they be on the same page?

That’s the idea – and it’s discombobulating when they’re not, hence the headlines… What’s happened is on Tuesday, Reserve Bank Governor Michele Bullock said serious consideration was given to lifting the official rate because of “the degree of excess demand in the economy”. Essentially that means we’re still in a spending mood, and that means prices will continue to go up at a rate that will eat into our nation’s standard of living. And yesterday, the central bank’s Chief Economist Sarah Hunter said government subsidies, including the Albanese Government’s $300 energy bill rebate for every household, weren’t helping. “And as a result of that, we think it’s going to take a little bit longer for inflation to get back to target,” Hunter said. Those positions are not ones that Treasurer Chalmers’ holds…

What’s he saying?

“I think it’s hard to sustain an argument that the economy is running too hot, or that people have too much spare cash given all of the data and all of the feedback that we get, which shows that’s not the case.” And he doesn’t accept that government spending is fuelling inflation. “What the forecasts say is that our cost-of-living policies are helping to push inflation down in the near term – not up.” Seizing on the rift is Coalition leader Peter Dutton – yesterday he said Team Albanese have “pumped $315 billion of additional money into the economy” and “that has fuelled inflation.” Cue excitement about next week’s release of the April-June wage price index and July’s labour market data. Economist Shane Oliver yesterday said they are numbers that are “going to be critical in all of this”.

Know someone who'd be interested in this story? Click to share...

The Squiz Today

Your shortcut to being informed, we've got your news needs covered.

Also Making News

Get the Squiz Today newsletter

Quick, agenda-free news that doesn't take itself too seriously. Get on it.